Epigenetic Testing for Insurance

Epigenetic Testing empowers both insurers and policyholders to make informed decisions based on individualized health insights, bringing Precision Health to a new level.

At Human Life Expectancy Inc. we have been pioneering the application of epigenetic testing for insurance and have developed a robust panel of epigenetic tests. Epigenetic tests analyze modifications in gene expression, influenced by various environmental factors, lifestyle choices, and genetic predispositions. This enables us to assess an individual’s health risks with unparalleled precision and offer personalized insurance plans that cater to their unique needs.

Why Epigenetic Tests?

- Unmatched Predictive Power: Epigenetic tests produce robust estimates of biological age, smoking and drinking status, and other factors that are important to insurers without raising clinical issues. They can also provide insights into an individual’s clinical health risks (including cardiovascular disease, diabetes, cancer and more) long before traditional symptoms manifest. This early detection allows insurance companies to take preventive measures, resulting in improved health outcomes and reduced healthcare costs.

- Personalized Insurance Plans: Epigenetic testing enables the tailoring of insurance plans to match the specific health risks of each policyholder. By providing coverage aligned with an individual’s health profile, insurers can enhance customer satisfaction and loyalty.

- Empowerment through Knowledge: Companies can also choose to incorporate epigenetic tests into insurance underwriting, giving policyholders a deeper understanding of their health risks and motivating them to adopt healthier lifestyles. This proactive approach promotes a win-win situation for both insurers and their customers.

- Cost-Effective Risk Management: Epigenetic testing assists insurers in better identifying high-risk individuals, leading to improved risk assessment and effective utilization of resources. This optimized risk management approach minimizes adverse selection and enhances overall profitability.

Our Epigenetic Testing Services:

- Epigenetic Health Assessments: A more comprehensive evaluation of a policyholder’s health risks based on epigenetic markers and lifestyle factors.

- Disease-specific Risk Analysis: Where desired and allowed, focused assessments for specific health conditions allow for targeted insurance plans.

- Personalized Health Recommendations: Actionable insights and personalized health recommendations that empower policyholders to take charge of their well-being.

- Long-Term Health Monitoring: Periodic epigenetic testing allowing insurers to monitor changes in health risks over time and focus on the interventions and behaviors that have the largest impacts on health and longevity.

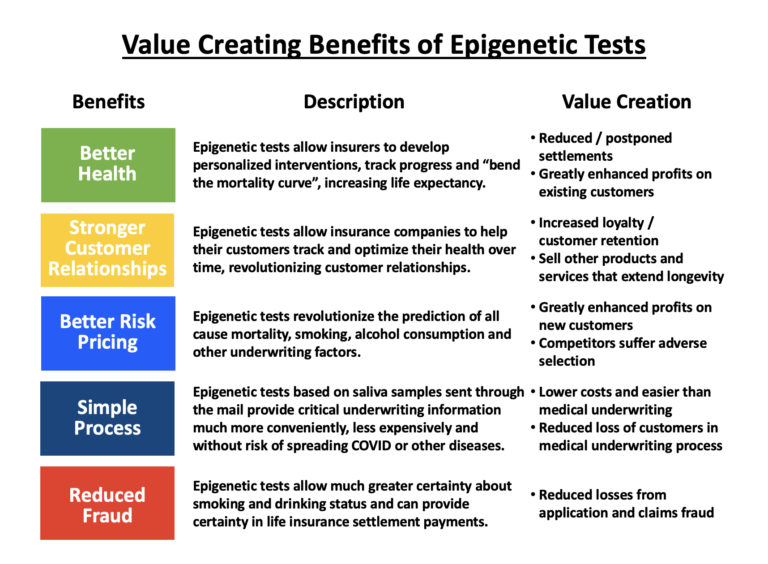

Integrating epigenetic tests into your insurance offerings can improve the health and well-being of your customers, enhancing your relationships and strengthening your brand. It can also improve pricing, simplify the underwriting process and reduce fraud.

We would be delighted to schedule a meeting to discuss how we can work together to bring the power of epigenetic testing to your company. Together, we can forge a future where precision health and insurance work hand in hand to create a healthier and more secure society.

Click here to schedule a convenient time to learn more.